Educational Sector

Our educational sector includes guides focused on different strategies and ideas to support your decisions in the Financial Market.

Alligator Strategy: Snapping the Market

In the financial market, the relentless search for advantages in anticipating trends often leads to confusing and inconclusive analyses, resulting in charts with a vast number of indicators that only hinder trend observation. In this context, simplicity and effectiveness are the highlights of the strategy developed by Bill Williams in 1995 in his book “Trading Chaos,” based on a single indicator of interest: Moving Averages.

What is the Alligator Strategy?

The Alligator Strategy consists of, like an alligator, biting its prey by opening its mouth, positioning its tongue, and preparing its jaw. The analogy also reflects that any strategy requires patience, as just like the alligator, the market goes through long phases of consolidation, like a sleeping alligator, and trends, when the alligator wakes up and feeds. In the financial market, the prey is the next trend being generated in a ticker of interest, so the strategy is based on using three smoothed moving averages, which represent the "jaws," "teeth," and "lips" of the alligator.

Components of the Alligator Strategy

- Jaws: Smoothed moving average of 13 periods shifted forward by 8 bars (candles). Represents the slowest movement.

- Teeth: Smoothed moving average of 8 periods shifted forward by 5 bars. Represents an intermediate movement.

- Lips: Smoothed moving average of 5 periods shifted forward by 3 bars. Represents the fastest movement.

How Does the Alligator Strategy Work?

The essence of the Alligator Strategy is to identify whether the market is in a consolidation or trend phase, using the behavior of the moving averages.

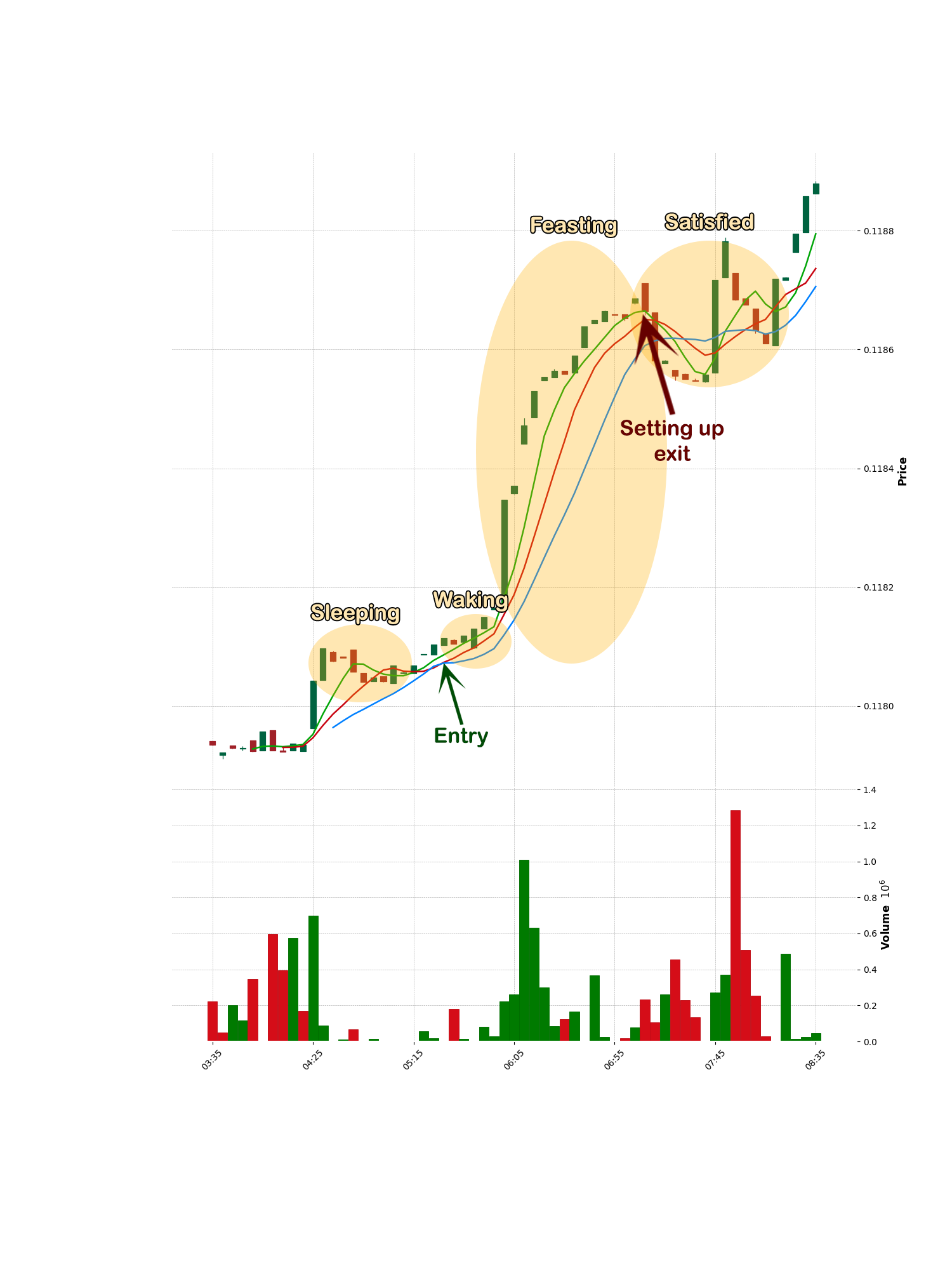

Alligator "Sleeping"

- The three moving averages are close to or intertwined with each other.

- Indicates a period of low volatility or market consolidation.

- It's a signal to be cautious and wait for a clear market direction.

- The longer the alligator sleeps, the hungrier it will be when it wakes up. Patience! Intense movements can arise at any moment.

Alligator "Waking Up"

- The moving averages begin to separate.

- For an uptrend, the lips are above the teeth, which are above the jaws.

- For a downtrend, the order is reversed.

- Signals the start of a new trend and is the time to consider entering the market.

Alligator "Feasting"

- The moving averages continue to diverge, confirming the strength of the trend.

- It is the period to maximize profits by keeping positions open.

Alligator "Satisfied"

- The moving averages start to come together again.

- Indicates that the trend is losing strength.

- Signals to close positions or adjust stops to protect profits.

Figure 1. Application of the Alligator Strategy in a bull market.

The Alligator Strategy in Practice

To use the Alligator Strategy effectively, follow these steps:

Signal Identification

- Observe the chart to identify when the moving averages are intertwined.

- Wait for a clear separation of the moving averages to identify the start of a new trend.

Market Entries

- Buy when the lips (green line) cross above the teeth (red line) and the jaws (blue line).

- Sell when the lips cross below the teeth and the jaws.

Position Management

- Use stop-loss to manage risk, positioning them below the moving averages in an uptrend or above in a downtrend.

- Adjust the stops as the trend develops.

Market Exits

- Consider closing positions when the moving averages start to come together again.

Advantages and Disadvantages of the Alligator Strategy

Advantages

- Simplicity: Easy to understand and implement.

- Effectiveness in Trending Markets: Helps capture significant movements in markets with clear trends.

Disadvantages

- False Signals: Can generate false signals in sideways or low volatility markets.

- Lag: There may be a delay in identifying trend changes, as with all moving average-based strategies.

Conclusion

The Alligator Strategy is a powerful tool in identifying trends in financial markets. By using smoothed moving averages, it helps differentiate between periods of consolidation and trends, providing clear signals for market entries and exits. Although it has its limitations, the simplicity and effectiveness in trending markets make the Alligator Strategy a valuable choice for many traders.

Even though it's very playful, the Alligator Strategy is based on a basic concept: Moving averages, in such a way that the shorter average should be positioned below the intermediate one, which in turn is positioned below the longer one.

Ready to put the Alligator Strategy into practice? Always remember to combine this strategy with good risk management and other technical analysis tools to achieve the best results. Always have PATIENCE: past movements do not necessarily reflect future movements, that is, indicators supplement strategies but do not define them.